Following a protracted legal melee, amendments to the National Planning Practice Guidance on planning obligations in May 2016 introduced changes to the way that affordable housing contributions can be sought from development. The changes include the introduction of vacant building credits which are intended to provide an incentive for brownfield development on sites containing vacant buildings.

There is still a degree of confusion around the use of vacant building credits and they are often overlooked when assessing the viability of brownfield sites. Part of the reason for this could be that most Local Authorities have not published a position or any guidance on their use. In fact, in two recent projects in two different Local Authorities, I discovered that the senior Case Officers had never heard of vacant building credits.

I then started researching to see if Local Authorities currently working on or have recently adopted Local Plans have referenced vacant building credits. Very few had, in fact I couldn’t find any in the North West region.

With most Local Authorities struggling to allocate enough land to meet their objectively assessed housing needs and the public outcry at the loss of greenfield and Green Belt land, the use of vacant building credits should be promoted by every Local Authority to ensure that previously developed sites can be financially viable for developers.

This article will explain the purpose of vacant building credits and how they have been successfully applied in recent projects.

National Planning Policy Guidance (“the Guidance”) explains that vacant building credits were introduced in May 2016 to incentivise redevelopment of brownfield sites containing vacant buildings. It states that:

“Where a vacant building is brought back into any lawful use, or is demolished to be replaced by a new building, the developer should be offered a financial credit equivalent to the existing gross floorspace of relevant vacant buildings when the local planning authority calculates any affordable housing contribution which will be sought.”

The Guidance expands on this by stating that the Local Planning Authority should apply a credit equivalent to the gross floorspace of any relevant buildings being brought back into use or demolished as part of the scheme and deduct that from the overall affordable housing contribution, whether that be an on-site contribution or a financial contribution.

A ‘relevant’ building for which vacant building credits can apply must not be abandoned. The Guidance suggests other appropriate considerations for the Local Planning Authority when assessing the suitability of a proposal using vacant building credits. These are:

Whether the building has been made vacant for the sole purposes of re-development; and

Whether the building is covered by an extant or recently expired planning permission for the same or substantially the same development.

In the case of a recent project where vacant building credits were used to offset the affordable housing contribution, it was demonstrated that the buildings have not been made vacant for the sole purposes of re-development. The buildings became vacant when the previous occupiers ceased operations in December 2015 following flood damage and went into liquidation in January 2016. To demonstrate that the buildings were not abandoned, evidence that they had been marketed for the past 12 months was provided.

The planning history of the site showed that there are no extant or recently expired consents for the same or similar development to the one proposed. The proposal was for residential development of 29 dwellings following the demolition of vacant industrial buildings.

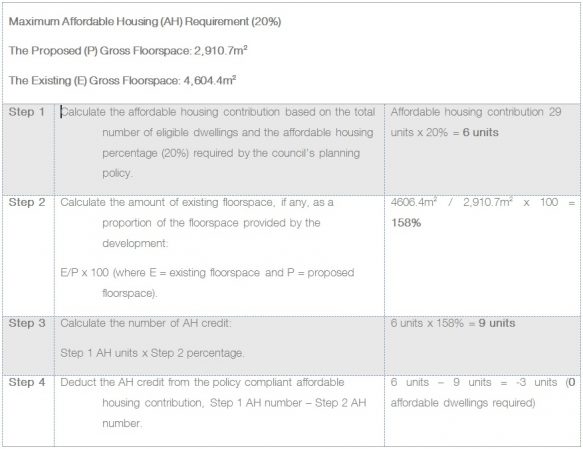

The Local Authority required a 20% affordable housing contribution, equal to 6 dwellings. This led to a financial viability concerns for the development.

The Local Authority had not published any guidance on the use of vacant building credits and the Principal Planning Officer had no knowledge of them.

After researching other Local Authority guidance on vacant building credits, I decided to use the Bath and North East Somerset Council methodology for calculating the vacant building credits. There are a number of different methodologies, with largely the same result, but the Bath and North East Somerset guidance was chosen as it appeared to be the most thorough, simple and recent guidance available.

The total floorspace to be demolished was 4,604.4m2.

The proposed development consisted of the 29 new dwellings that had a combined floorspace of 2,910.7m2.

The result of the proposed development is a decrease in floorspace of 1,695.7m2

Using the Bath and North East Somerset methodology, the calculation to determine the affordable housing contribution would be as follows (click to enlarge image):

As demonstrated in the above calculation, the vacant building credits are greater than the affordable housing requirement, resulting in a negative figure when calculating the contribution. As such, there is no affordable housing requirement for the proposed development.

The use of vacant building credits established a financially viable residential use for the site, meaning that the flood damaged industrial buildings could be taken off the market, demolished and the site re-used. Furthermore, it was not necessary to provide a financial viability assessment of the proposal, which can be very costly and time-consuming.

The mandatory requirement for Local Authorities to prepare brownfield registers presents an ideal opportunity to publish guidance on the use of vacant building credits. With talk of tighter controls on the use of viability assessments to offset affordable housing contributions and increasing pressure on greenfield sites, vacant building credits are an important tool that Local Authorities and planners should utilise.

Government advice on vacant building credits can be found here at Paragraph 021.